20 Free Reasons For Deciding On Ai Investing

20 Free Reasons For Deciding On Ai Investing

Blog Article

Top 10 Tips For Regularly Monitoring And Automating Trading Stock Trading From Penny To copyright

It is important to automatize your trading and track it regularly, especially on fast-moving stock markets like the penny and copyright markets. Here are 10 tips to help you automate your trades and ensure continuous performance through regularly monitoring.

1. Clear Trading Goals

Tip: Identify your goals for trading, such as your risk tolerance, the expected return and your preferred asset.

What is the reason: A clear objective guides the selection of AI algorithm, risk management rules and trading strategies.

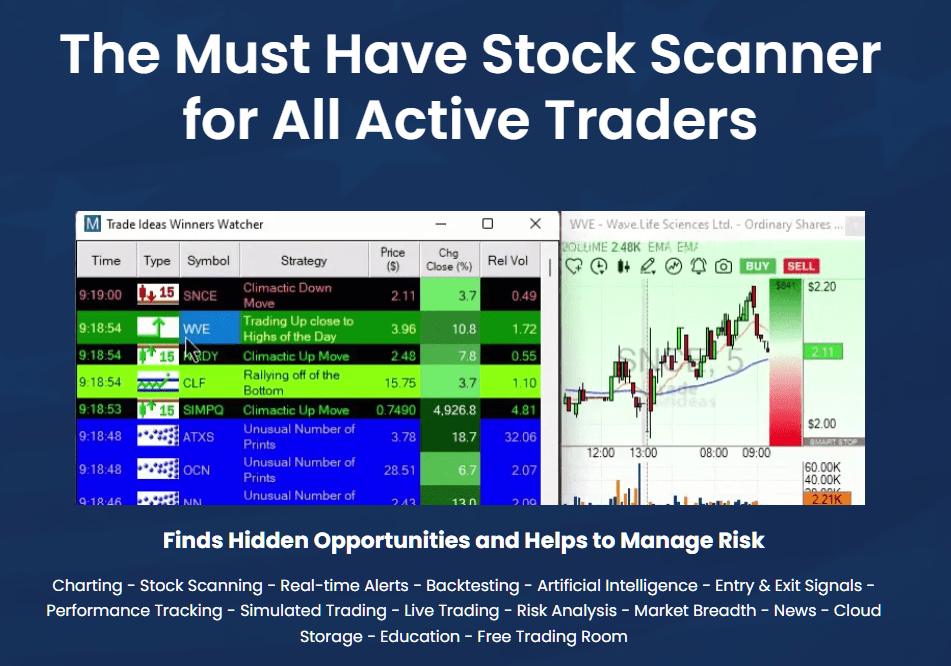

2. Trading AI Platforms that are reliable

Tip: Look for trading platforms that are powered by AI that are fully automated and integrate with your broker or copyright exchange. Examples include:

For Penny Stocks: MetaTrader, QuantConnect, Alpaca.

For copyright: 3Commas, Cryptohopper, TradeSanta.

What is the reason? An automated platform should have an effective execution capability.

3. Customizable Trading Strategies are the main focus

Make use of platforms that let you design or modify trading strategies that are tailored to your specific method (e.g. trend-following or mean reversion).

What's the reason? The strategy is customized to your style of trading.

4. Automate Risk Management

Tip: Automate your risk management using instruments like trailing stop as well as stop-loss order and take-profit thresholds.

This will safeguard you from massive losses in volatile markets, like penny stocks and copyright.

5. Backtest Strategies Before Automation

Test your automated methods back to test their effectiveness.

Why is it important to backtest? Backtesting allows you to establish if a strategy is viable, thus reducing the risk of a poor performance on live markets.

6. Monitor performance regularly and make adjustments settings

Tips: Even if trading could be automated, monitor your performance regularly to spot any problems.

What to monitor How to measure: Profit and loss slippage, and whether the algorithm is in line with the market's conditions.

Why: A continuous monitoring process allows you to make adjustments in time if conditions on the market alter. Then you can make sure that your strategy remains effective.

7. Adaptive Algorithms Use them

Tips: Select AI tools that are able to adapt to changing market conditions by adjusting trading parameters based on real-time data.

Why is this: Markets are constantly changing, and adaptive algorithms allow you to adapt your strategies, be it for copyright or penny stocks according to trends and fluctuations.

8. Avoid Over-Optimization (Overfitting)

Over-optimizing systems can cause excessive fitting. (The system works well on backtests but badly under actual situations.

Why: Overfitting reduces your strategy's capacity to generalize to new conditions.

9. AI is an effective instrument to detect market anomalies

Make use of AI to detect unusual market patterns and anomalies in the data.

Why? Because by recognizing these indicators early, you can adjust your automated strategies ahead of a significant market movement.

10. Integrate AI to provide regular alerts and notifications

Tip: Create real-time notifications to alert you of important markets events, trades executed or any changes in your algorithm's performance.

What's the reason? You'll be informed about critical market movements and take swift action if required (especially for volatile markets, such as copyright).

Cloud-based services are a great way to scale up.

Tip: Use cloud-based trading platforms to boost scaling. They're more efficient and let you run different strategies at the same time.

Cloud-based solutions let your trading system run all day long all week long and without interruption. This is vital for copyright markets that will never shut down.

Automating and monitoring your trading strategies, you can improve efficiency and reduce risk by using AI to manage copyright and stock trading. Follow the top rated best ai copyright for site info including penny ai stocks, ai investment platform, copyright ai, trade ai, ai stock analysis, ai for stock trading, ai trading software, trade ai, using ai to trade stocks, stock ai and more.

Top 10 Tips For Regularly Improving And Updating Models For Ai Stocks And Stock Pickers

Continuously updating and enhancing AI models for stock picking as well as investment predictions is vital to ensure accuracy, adjusting to market changes and improving overall performance. When markets shift as do AI models. Here are ten tips to improve and update your AI models.

1. Continuously Integrate Fresh Market Data

Tip - Regularly integrate the most recent market data including stock prices reports, earnings as well as macroeconomic indicators.

AI models that are not up-to-date with current data will become outdated. Regular updates ensure that your model is aligned with market patterns and improve accuracy in prediction.

2. Check the performance of models in real-time.

Utilize real-time tracking to observe how your AI model performs under live market conditions.

Why? Monitoring performance can allow you to recognize issues, such as model drift. When the model's accuracy declines over time, it gives you the chance to alter and fix the issue.

3. Continuously train models using new data

Tip : Retrain AI models frequently (e.g. on the basis of a monthly or quarterly schedule) with the most recent historical information. This will refine your model and let you adapt it to market dynamics which are constantly changing.

Why: Market conditions change, and models trained using outdated data can be less accurate in their predictions. Retraining helps the market model learn about recent developments and patterns in the market, which ensures that it's still relevant.

4. Tuning hyperparameters improves accuracy

Tips: Ensure that you regularly optimize the parameters that you use to build your AI models (e.g. the learning rate, the number of layers, etc.). Random search, Grid search or other optimization techniques can assist you in optimizing AI models.

The reason: Proper adjustment of the hyperparameters you use is vital to ensure that your AI models work at their best. This improves accuracy in prediction, and also help to prevent overfitting (or underfitting) to historical data.

5. Test new features and variables

TIP: Always try various features and sources of data to improve your model and discover new connections.

What's the reason? Adding relevant new features can improve model accuracy because it gives the model access to nuanced information.

6. Utilize ensemble methods to make better prediction

Tip: Use methods of ensemble learning such as bagging or stacking to combine AI models. This improves the accuracy of your prediction.

The reason: Ensemble methods increase the robustness and accuracy of AI models. They achieve this by drawing strengths from different models.

7. Implement Continuous Feedback Loops

TIP: Make use of feedback loops to constantly refine your model by looking at the actual market results and forecasts from the model.

Why: A feedback system ensures the model learns from its real-world performance. This helps identify any imperfections or biases that need adjustment, and also improves the model's future predictions.

8. Include regular stress tests and Scenario Analysis

Tip: Periodically stress-test your AI models with possible economic conditions, including crashes, extreme volatility, or unexpected economic events, to test their robustness and their ability to deal with unexpected scenarios.

The reason: Stress testing makes sure that the AI model is ready for a variety of market conditions. Stress testing can be a way to determine whether the AI model is afflicted with any weaknesses that could result in it not performing effectively in extreme or high-volatility market conditions.

9. Keep Up with Advances in AI and Machine Learning

Stay up-to-date on the latest AI tools, techniques and algorithms. You can incorporate AI techniques into your models.

The reason: AI, a field that is constantly evolving, can improve model performance and efficiency. It also improves accuracy and precision in stock selection and prediction.

10. Always evaluate, adjust and manage Risk

Tip : Assess and refine regularly the risk management aspects of your AI models (e.g. position sizing strategies and stop-loss strategies, risk-adjusted results).

Why: Risk management when trading stocks is vital. The AI model has to be regularly examined to make sure that it does not just maximize returns, but also manages market risk.

Bonus Tip: Keep track of Market Sentiment and incorporate it into Model Updates

Tips: Incorporate the analysis of sentiment (from news, social media and more.) in your model update. Your model can be updated to keep up with changes in the psychology of investors, market sentiment, and other elements.

Why: Market sentiment can greatly affect the price of stocks. The incorporation of the analysis of sentiment into your model allows it to react to broader emotional or market mood changes that might not be recorded by the traditional data.

The article's conclusion is:

By updating and optimizing your AI stock picker and predictions and strategies for investing, you will make sure that your model is both accurate and competitive, even in a market constantly changing. AI models that are continually trained and refined with new information and also incorporate real-time feedback, along with the latest AI developments, will give you an edge in stock predictions and investment decision making. Have a look at the most popular ai trading bot for site examples including trading bots for stocks, ai investing, coincheckup, ai investing app, ai stock trading app, ai investing app, ai stock price prediction, best copyright prediction site, investment ai, ai for stock trading and more.